The maximum withdrawal limit can vary because it depends on your account and your relationship with U.S. Bank. For many banks, daily ATM withdrawal limits start at $500. You have the power to set your own ATM withdrawal limit through the U.S. Bank mobile app. As long as your limit falls within U.S. Bank's minimum and maximum amounts, you're.. 4 minute read. To answer the question "Can you deposit cash at an ATM ?", the answer is yes, you can - but not without some important caveats. For example, some ATMs don't accept cash deposits, or you may have to find an ATM that's part of your bank or in a participating network. Let's find out how to find an ATM that takes cash.

How to Deposit Cash Local Banks, ATMs, and Online Banks

Cardless ATMs Can Keep Money Safer YouTube

Can you deposit cash at an ATM that's not your bank? YouTube

Chase ATM Cardless Access How To Use Chase ATMs With Your Mobile Wallet YouTube

How cardless cash ATMs work YouTube

How to deposit cash at US Bank ATM? YouTube

Can I deposit cash in any ATM to any bank account? YouTube

Can You Deposit Cash At An ATM? Forbes Advisor

How safe is it to deposit cash into an ATM?

How to Check FNB eWallet Balance, Send or Withdraw Money from the Service

Bank Of America Cardless Atm Near Me change comin

बिना ATM Card के पैसे कैसे जमा करे How To Deposit Cash Without ATM in SBI Cash Deposit

How to deposit money in ATM Machine Without ATM Card Cardless Deposit தமிழில் YouTube

How Do I Deposit Cash Into An ATM?

How to Withdraw Cash from Standard Chartered ATM without ATM Card

PNC Bank Upgrades 3,600 ATMs To Deposit Checks And Cash

How cash Deposit without ATM card part 2 YouTube

Can I deposit cash at a Citibank ATM? YouTube

How to deposit cash at BRI ATMs easily and without a card

HOW TO DEPOSIT MONEY IN ATM MACHINE YouTube

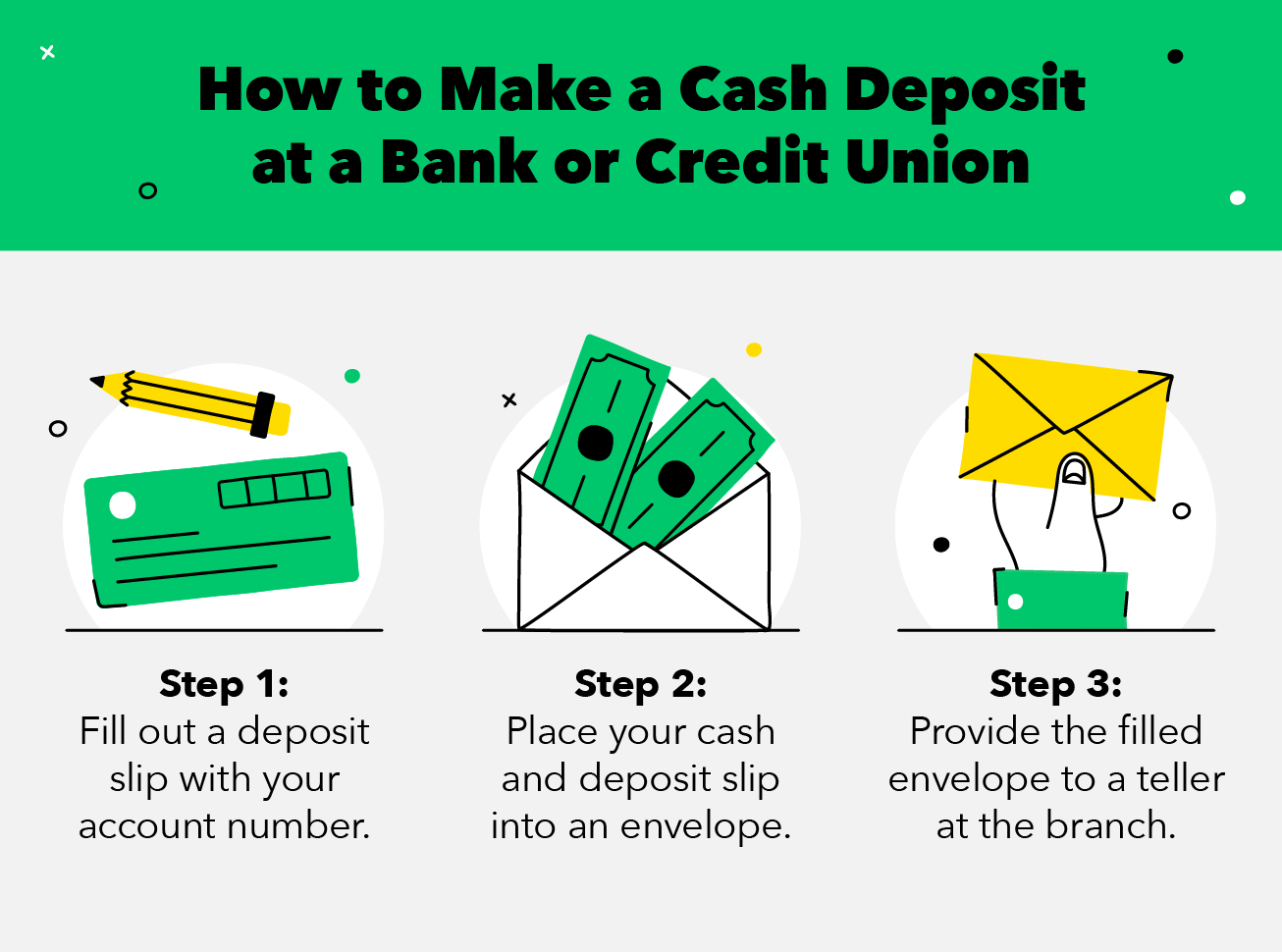

To deposit your cash, you'll use the ATM just as you would for any other transaction, following the prompts on the screen to insert your money. Some online banks allow for ATM cash deposits.. If you're a business customer, you can deposit cash and cheques using barcoded deposit slips linked to your nominated NAB transaction account. Bank@Post lets you: make deposits in notes and coins of up to $9,999 per customer, per day. make cheque deposits of up to 99 cheques per transaction with a value up to $999,999.99.